Critical Illness Insurance is protection for your lifestyle. It is designed to alleviate the financial burden that suffering a critical illness can create.

Critical Illness Insurance pays a one-time lump sum benefit thereby allowing you to make the best possible medical decisions without any financial constraint.

Critical Illness Insurance pays out regardless of your ability to return to work and your claim is independent from your disability insurance.

Product Attributes

- Coverage available up to age 75 or 100.

- 25 covered conditions (e.g. Heart attack, Stroke, MS, Cancer, Coronary artery bypass surgery).

- Pays a tax-free lump sum of up to $3,000,000 if you are diagnosed with, and survive, a covered condition.

- Return of premium is available after 15 years; or at policy surrender and/or at expiry.

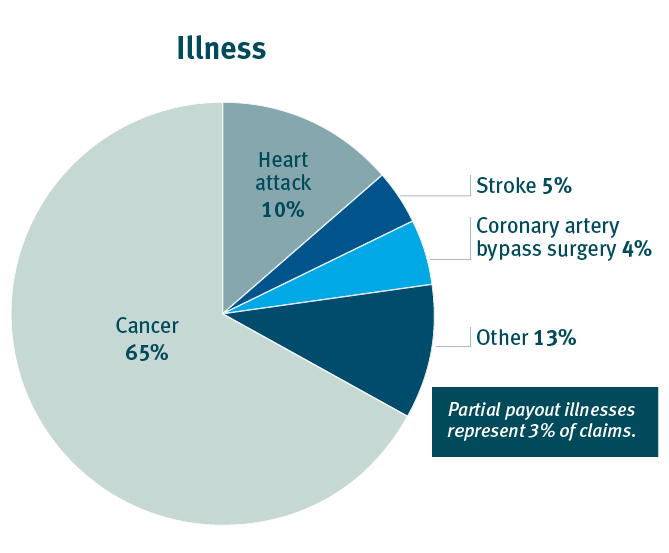

Insurance Fact: Which illnesses account for the most critical illness claims?

Sun Life Financial – 2021

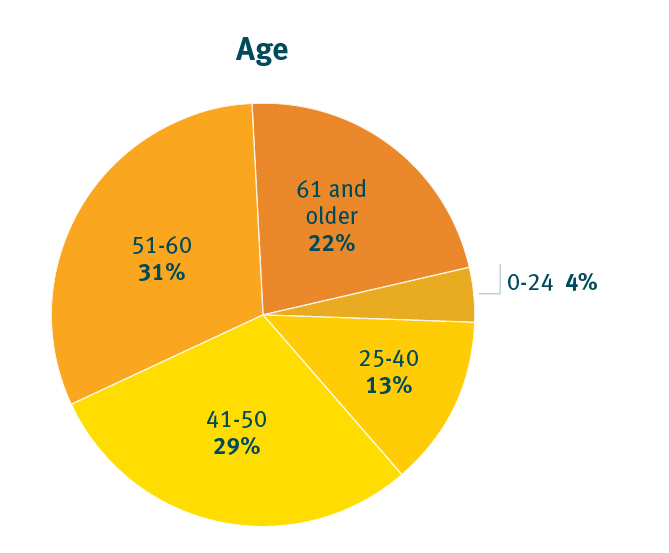

Insurance Fact: What is the percentage of critical illness claims by age?

Sun Life Financial – 2021

We recommend reviewing your critical illness coverage every few years to ensure you have the most up-to-date policy provisions and definitions.